For Muslim investors in the UK, navigating the financial markets while adhering to Islamic principles requires careful consideration of Shariah compliance. Understanding which investments align with Islamic law (Shariah) is crucial for building a portfolio that reflects your religious values whilst pursuing financial growth.

Understanding Shariah Investment Principles

Islamic finance operates on several fundamental principles that distinguish it from conventional investing. These principles shape every aspect of permissible investment activities.

Prohibition of Riba (Interest)

Islam strictly forbids charging or paying interest. This means conventional savings accounts, bonds, and other interest-bearing investments are not permissible. Instead, Islamic finance emphasises profit and loss sharing arrangements where returns are generated through legitimate business activities.

Avoiding Haram Industries

Investments in companies whose primary business involves alcohol, gambling, pork products, conventional banking, or adult entertainment are prohibited. This extends to companies that derive significant revenue from these activities, even if they’re not the primary focus.

Risk Sharing

Islamic finance encourages genuine risk-sharing between investors and businesses. Speculative investments resembling gambling are avoided, while partnerships with shared rewards and risks are encouraged.

Asset-Backed Transactions

All investments must be backed by tangible assets or legitimate business activities. This principle excludes purely speculative financial instruments and ensures investments contribute to real economic activity.

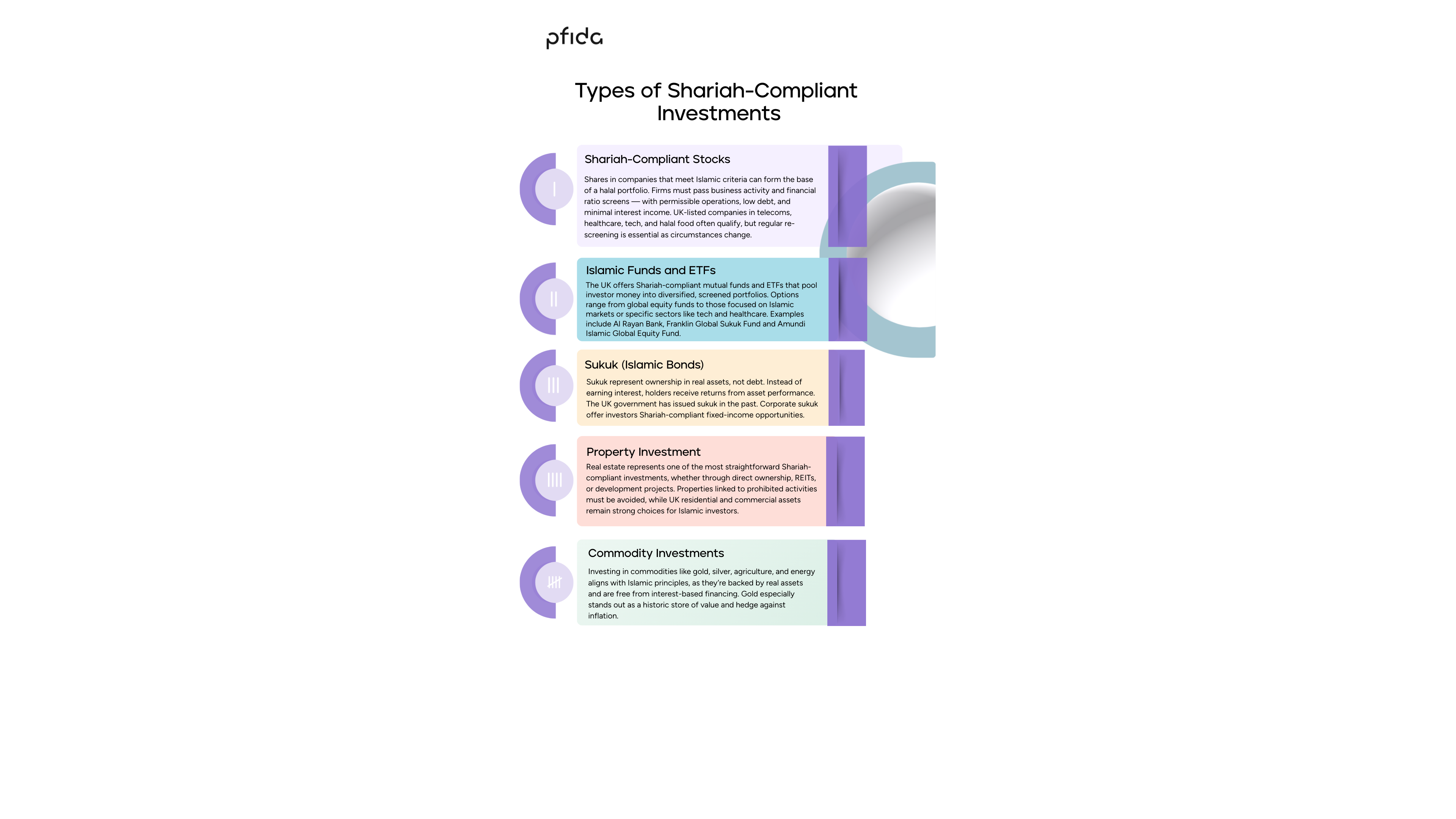

Types of Shariah-Compliant Investments

Islamic Funds and ETFs

In the UK, investors have access to a wide range of Shariah-compliant mutual funds and exchange-traded funds (ETFs). These are professionally managed investments that pool money from multiple investors to create diversified portfolios of Shariah-screened securities.

Some of these funds focus on global equities, investing in Shariah-compliant companies worldwide, while others specialise in specific markets or sectors such as technology or healthcare.

- Al Rayan Islamic Asset Management Funds

Al Rayan Bank provides a range of Shariah-compliant funds, including equity and sukuk (Islamic bonds) options. These funds are designed to meet the needs of UK-based Muslim investors and strictly adhere to Islamic finance principles. - Franklin Global Sukuk Fund

This fund specialises in sukuk, offering UK investors a Shariah-compliant alternative to conventional fixed-income investments. It is structured to align with the principles of Islamic finance. - Amundi Islamic Global Equity Fund

Amundi offers a Shariah-compliant fund that invests in global equities screened to ensure compliance with Islamic principles. This makes it a strong choice for UK investors seeking halal investment opportunities.

Screening and Due Diligence

Maintaining Shariah compliance requires ongoing vigilance. Companies may change their business focus or financial structure, potentially affecting their compliance status. Many investors rely on specialised Shariah advisory firms or scholars who provide regular screening updates.

Key screening criteria include:

- Primary business activities must be permissible

- Interest income should not exceed 5% of total revenue

- Interest-bearing debt should not exceed 33% of market capitalisation

- Liquid assets should not exceed 33% of market capitalisation

Building a Diversified Portfolio

A well-constructed Shariah-compliant portfolio can achieve diversification across asset classes, geographical regions, and sectors. This might include:

- UK and international Shariah-compliant equities

- Property investments through direct ownership or REITs

- Sukuk for fixed-income exposure

- Commodity investments for inflation protection

- Cash holdings in Shariah-compliant savings accounts

Challenges and Considerations

Shariah-compliant investing does present certain challenges. The investment universe is smaller than conventional markets, potentially limiting diversification options. Some sectors, particularly financial services, are largely unavailable to Islamic investors.

Conclusion

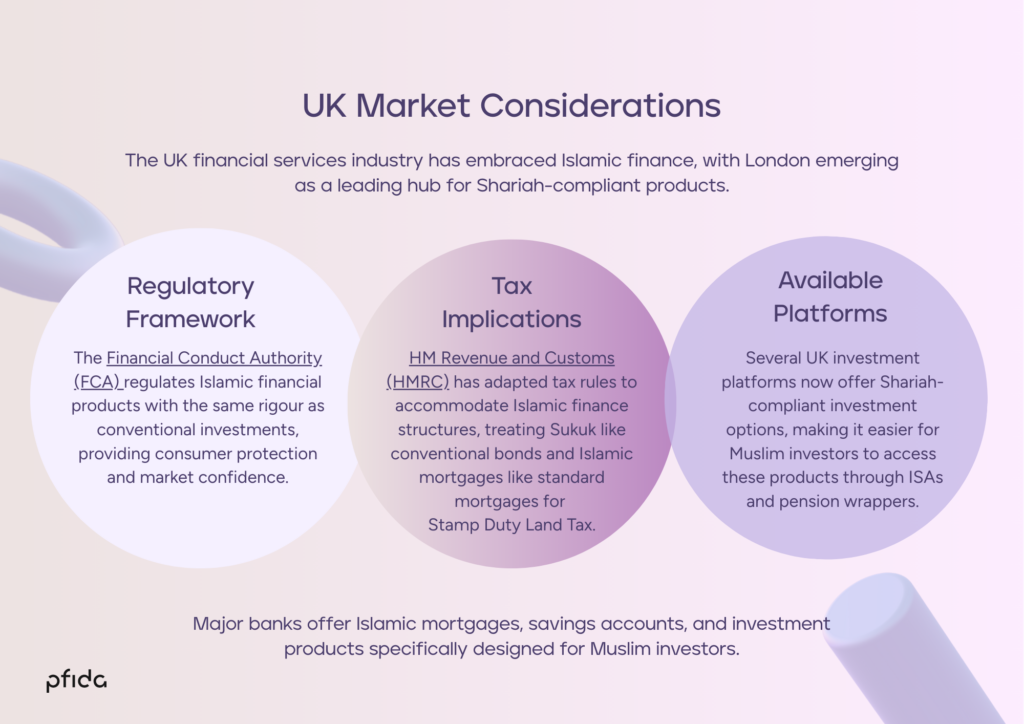

Shariah-compliant investing in the UK offers Muslim investors the opportunity to grow their wealth whilst adhering to Islamic principles. Whilst the investment universe may be more limited than conventional markets, the available options provide adequate diversification and growth potential.

Success requires understanding the underlying principles, conducting proper due diligence, and potentially seeking guidance from qualified Islamic scholars or financial advisors with expertise in Shariah-compliant investments. With careful planning and appropriate product selection, Muslim investors can build robust portfolios that reflect both their financial goals and religious convictions.

The continued development of the UK’s Islamic finance sector suggests even more opportunities will emerge, making Shariah-compliant investing an increasingly viable option for Muslim investors seeking to participate in the financial markets whilst maintaining their religious values.